By 2022, the level of global mergers and acquisitions (M&A) activity involving technology providers will surpass previous highs recorded in 2018, according to Gartner.

Acquisitions of tech providers were briefly impacted in 2020 by the onset of the pandemic, but M&A activity quickly rebounded into 2021 as the economy began to recover.

“Market conditions for deal making will continue to improve as volatility stemming from COVID-19 subsides,” said Max Azaham, Senior Research Director at Gartner. “Tech CEOs pursuing acquisitions should anticipate increased competition for targets and take steps to gain advantages over other acquirers to earn seller acceptance.”

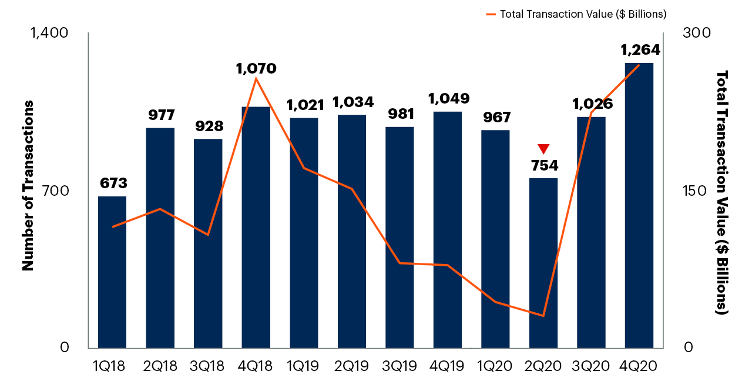

Acquisition activity was most adversely impacted during the second quarter of 2020, but activity in the fourth quarter was higher than in the last two years (see Figure 1). Acquisitions of communications providers led the rebound in the second half of 2020, followed by acquisitions of services and software companies.

Figure 1. Technology and Service Provider M&A Transactions and Value by Quarter – US, Canada and Europe

Source: Gartner (May 2021)

Source: Gartner (May 2021)

Financial acquirers demonstrating growing interest, especially in software providers

Acquisitions of technology providers are met with increasing interest among financial services companies, predominantly private equity firms.

Throughout 2020, financial acquisitions of software providers represented over half of all such acquisitions. Despite software already being the largest category, financial acquirers’ increasing interest should drive higher activity in 2021.

The largest M&A activity gains in the second half of 2020 involved financial acquisition of communications providers (93% growth), and acquisitions of services providers by financial acquirers were 30% higher in the fourth quarter of 2020, compared to the prior two years’ average.

Consolidation trends indicating high degree of overlap between acquirers and targets

Consolidation of providers with high degrees of overlap increased by 65% and 40% in services and software markets, respectively, in the second half or 2020, compared to the average number of M&A transactions in 2018 and 2019 (transactions of over $1 billion in value were excluded)

These consolidation trends suggest tech CEOs must be prepared for competitive landscapes where key competitors merge, especially among service providers.

Max Azaham,Instead of making acquisitions or being acquired, tech CEOs will start to consider partnerships and ecosystems to level the playing field against larger companies resulting from consolidation in their markets,” said Azaham.

M&A impacts on enterprise customers

The expected uptick in M&A activity throughout this year cannot leave existing customers behind. Successful acquirers will consider the implications for end-users and make customer experience (CX) a top priority across each stage of the M&A life cycle.

CIO customers of vendors undergoing an integration expect minimal service disruptions and transparent communications on product, pricing and support changes, if any. “Without empathy and a deep understanding of what motivates the existing customer base, organizations risk acquiring a customer base that will churn following deal closure,” said Azaham.

Discussion about this post