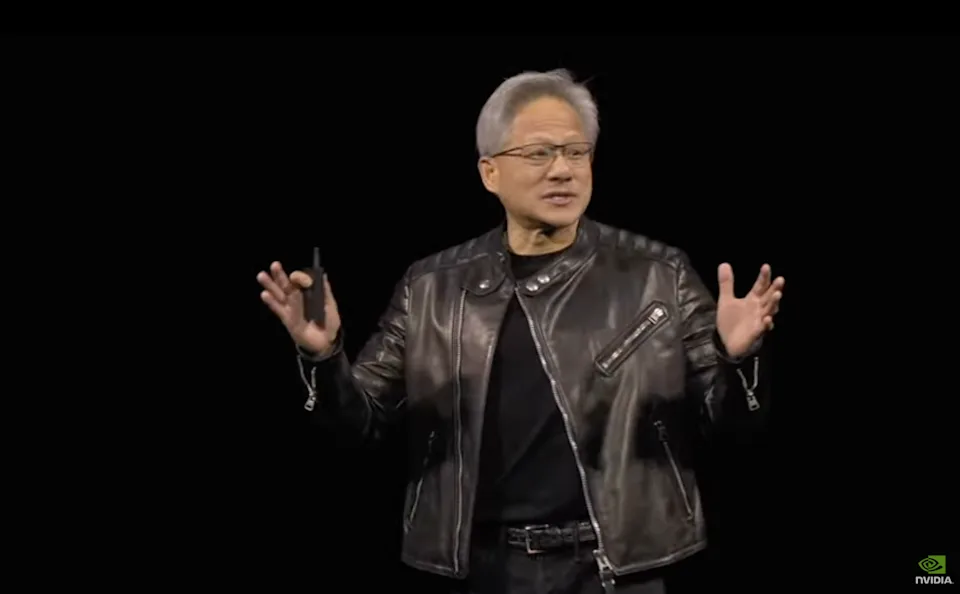

At its annual GTC event in San Jose, Nvidia CEO Jensen Huang introduced the Blackwell Ultra AI chip, the latest advancement in AI processing. Alongside it, the company announced the GB300 superchip, which integrates two Blackwell Ultra chips with Nvidia’s Grace CPU. These cutting-edge processors are designed to power AI workloads for major hyperscalers such as Amazon, Google, Microsoft, and Meta, as well as research institutions worldwide.

Breakthrough in AI performance

The Blackwell Ultra delivers 1.5x the performance of its predecessor, Blackwell, and represents a 50x increase in data centre revenue potential compared to the Hopper chip. Designed for the “age of AI reasoning,” this chip enables AI models to process information and draw conclusions more efficiently, a capability popularised by DeepSeek’s R1 AI model and mirrored in OpenAI’s o1 and Google’s Gemini 2.0 Flash Thinking.

Nvidia has dismissed claims that AI reasoning models can function effectively on lower-end chips, emphasising that high-performance GPUs accelerate AI inference and deliver faster, more accurate responses.

Supercharging AI infrastructure

The Blackwell Ultra is designed to integrate seamlessly into Nvidia’s NVL72 rack server, which houses 72 GB300 superchips. This configuration significantly enhances system efficiency and serviceability. According to Nvidia, the GB300 NVL72 can process 1,000 tokens per second when running DeepSeek’s R1 model—a tenfold increase over the Hopper chip, which handled only 100 tokens per second. This advancement cuts AI response times from 1.5 minutes to just 10 seconds.

For even greater computing power, Nvidia is incorporating the GB300 into its DGX SuperPod AI supercomputer, which consists of multiple NVL72 servers. The SuperPod boasts 576 Blackwell Ultra GPUs, 288 Grace CPUs, and 300TB of memory, making it a powerhouse for AI training and inference.

Rapid market adoption and challenges ahead

With Blackwell Ultra now in full production, Nvidia reports that its rollout has been the fastest in company history. In the most recent quarter, Blackwell chips contributed $11 billion to Nvidia’s $39.3 billion total revenue.

Despite strong financial performance, Nvidia’s stock faces pressure due to concerns that hyperscalers are overinvesting in AI without realising sufficient returns. Additionally, geopolitical risks, including a potential 25 per cent tariff on overseas semiconductor production and tighter export controls, have raised uncertainty in the market.

As AI continues to evolve, Nvidia remains at the forefront, driving innovation with its next-generation chips and AI-powered infrastructure.

Discussion about this post