In this digital era, budgeting apps have become essential tools for managing wealth and personal finances effectively. By harnessing the latest technological advancements, they offer unparalleled convenience at our fingertips. However, this comfort and luxury raises a crucial question: how do these apps protect our personal financial information, especially given the alarming rise in cyberattacks on fintech companies – of which UAE-based organisations experienced 53% in the last quarter of 2024 alone.

The Evolving Landscape of Fintech Security

According to a 2023 report by Veritas, companies in the UAE have been increasing budgets over the past 12 months by 29-35% on average as compared to 28-30% per cent globally). This is in response to assurance to the public that their personal data and money are safeguarded. This growing awareness has triggered a paradigm shift in the fintech industry, moving from reactive data security measures to a proactive approach. Such pre-emptive threat detection necessitates sophisticated technologies to identify and mitigate threats before damage occurs.

A Multi-Layered Security Approach

A comprehensive security strategy requires a multi-faceted approach. This includes fundamental security measures like:

- Encryption: Utilising industry-standard algorithms to encrypt all sensitive data and traffic.

- Multi-Factor Authentication (MFA): Implementing MFA and adapting security levels based on real-time inputs from the threat-protection system.

- Access Control: Establishing stringent controls to safeguard customer data, ideally requiring maker-checker processes and time restrictions when accessing sensitive information.

- Security Audits: Investing in external audits to ensure the security infrastructure is rigorously peer-reviewed by experts.

- Network Security: Employing next-generation firewall systems with advanced intrusion protection.

- Incident Response Procedure: Implementing a robust incident response process to address any security breaches effectively.

Artificial Intelligence: A Game-Changer in Fintech Security

One of the most significant breakthroughs in security is integrating artificial intelligence (AI). Advanced AI models now possess the capability to analyse vast and diverse data sets in real time, detecting anomalies and patterns that could signal fraudulent activity or cyber threats. By monitoring transactions as they occur, AI can swiftly flag suspicious behavior, prompting additional authentication measures to ensure the transaction’s legitimacy.

As threat complexities have escalated, these controls are no longer a ‘good to have’ luxury but a ‘must-have’ necessity. Companies must invest in technological prowess to keep pace with the evolving threat landscape.

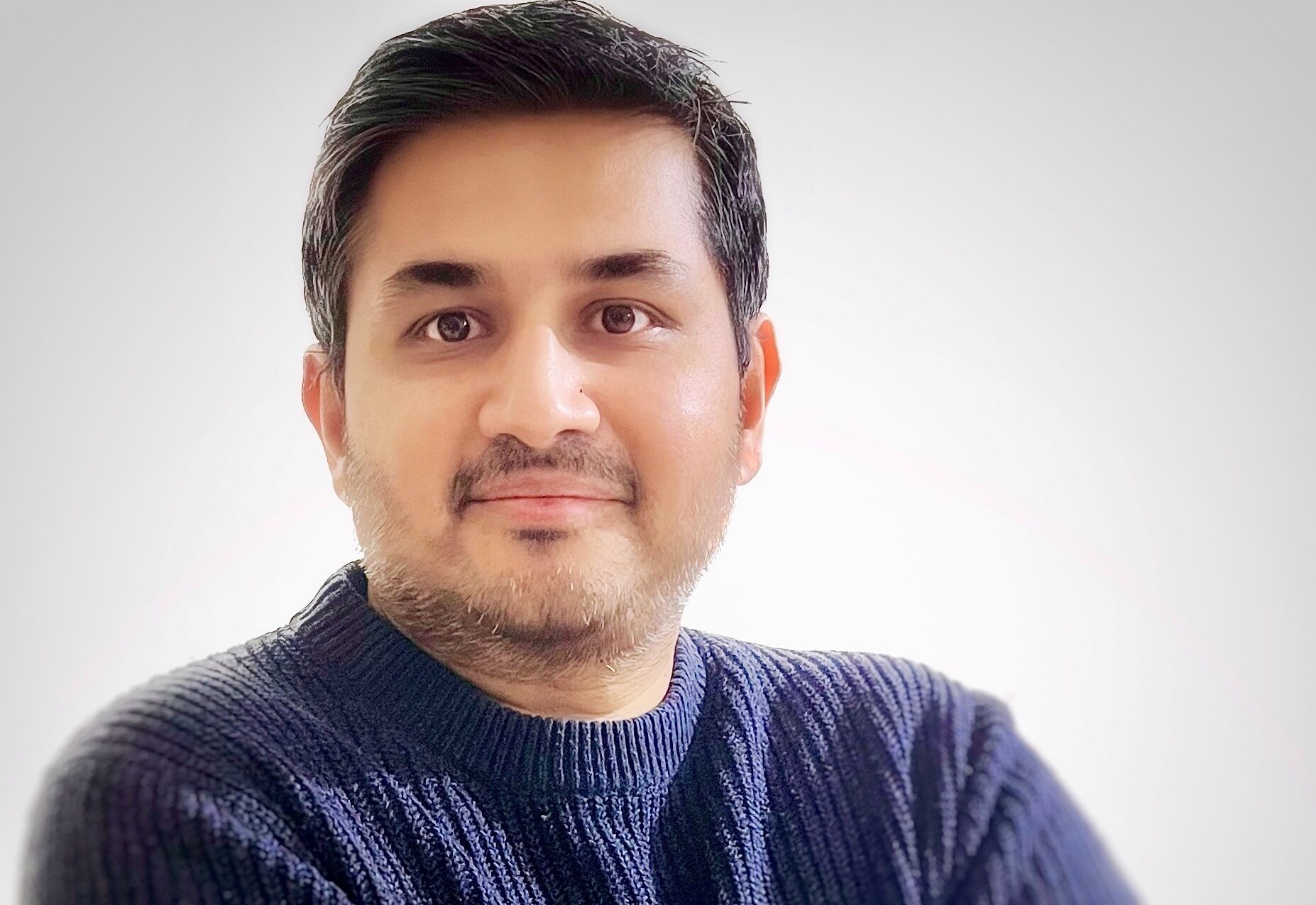

Sav: Leading by Example

At Sav, our commitment to security is unwavering and we have adopted a ‘no compromise’ approach to data privacy and data security. Our infrastructure is hosted by industry-leading cloud providers like Microsoft Azure and Google Cloud Platform, trusted by banks and financial institutions worldwide. We have invested substantial time, effort, and resources to build a robust security framework and Security Information and Event Management (SIEM) policies that adheres to the highest industry standards.

Our commitment extends beyond technology. We work tirelessly to educate users, providing guidelines and resources on staying safe in the digital realm. This holistic approach to security has earned us the trust of our users, who rely on Sav to manage their wealth confidently.

The Future of Fintech Security

The rise of artificial intelligence presents both challenges and opportunities in security. As AI continues to evolve, so too will the threats it poses. However, AI also empowers us to develop more sophisticated defence mechanisms. Sav is dedicated to staying at the forefront of this technological evolution and leveraging emerging technologies like AI-powered security while educating users on how to protect themselves. This ensures that your information remains secure even as new challenges emerge.

Discussion about this post